Investors may have heard about opportunities to profit from the Uranium market over the last few days. However, before jumping on board the talk of many social media message boards, we think it is important for investors to know some basics.

What is uranium?

Uranium is a heavy, dense, and radioactive metal that can be a source of energy. It is found in many rock types within the Earth’s crust and is recovered using open-pit mining, underground open-pit mining, underground mining, and in-situ leach mining techniques. After mining, it is put through a milling process to generate something called Yellowcake which can be enriched and used for nuclear fuel.

What are the advantages of uranium as a source of electricity?

There are three key advantages of uranium as a source of electricity. First, it is extremely efficient as it can generate a lot of electricity through the process of nuclear fission. Second, the ongoing costs of generating power at nuclear power plants is extremely low relative to other energy sources because it can be done with low amounts of uranium. Third, it is a very clean source of energy as it produces very low levels of greenhouse gas emissions.

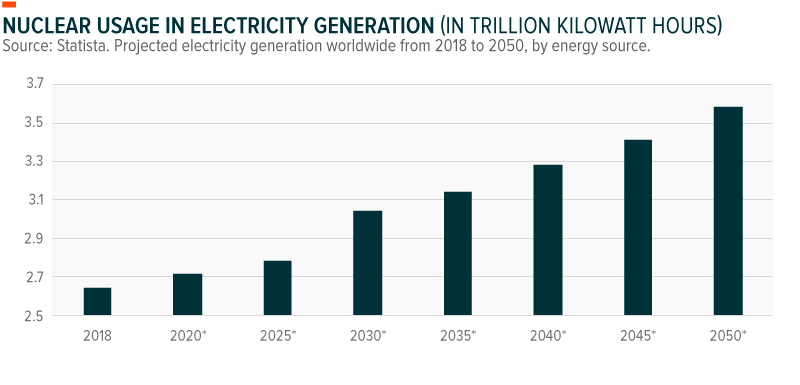

What is the outlook for uranium demand?

Nuclear power generates approximately 10% of the worlds energy. According to the World Nuclear Association, there are currently about 445 nuclear power reactors operating in 32 countries plus Taiwan. These reactors generate approximately 10% of the worlds energy. There are another 50 reactors currently being constructed in 19 countries and many more planned.

Therefore, uranium demand should remain strong with UxC estimating demand growth of 49% to over 290 million pounds by 2035.

What is the outlook for uranium supply?

We believe uranium supply is likely to remain tight. Afterall, the world’s largest uranium producer, Kazatomprom cut production coming into 2021 by 20% and we have seen supply reduced due to the temporary closure of Cameco’s McArthur River mine and the permanent shut down of other uranium miners’ operations due to depletion. These are very meaningful reductions to supply which are unlikely to reverse until uranium prices are significantly higher at which time Kazatomprom and Cameco may bring production back online.

Will uranium prices go up?

We think the answer is yes. In addition to the favorable supply/demand dynamics mentioned above, the recent move by Sprott Inc. to launch an at-the-market equity program for its Physical Uranium Trust will produce buying of uranium that should drive prices considerably higher.

The Physical Uranium Trust was created by Sprott to hold all its assets in physical uranium. With the ATM program they announced, as units are sold, cash is used to go into the spot market to buy physical uranium. Initially, it started as a $300M ATM program. However, last week the at-the-market equity program was increased to $1.3B. This means there’s a lot of supply that is going to be bought up in the spot market by Sprott and provides the backdrop for potentially explosive moves higher in the spot price of uranium.

What are some ideas for investing in uranium?

With so many investors looking to possibly get exposure to the uranium trade, naturally some are asking what is the best way to get exposure. We think there are three good options for retail investors. In no particular order, there are Uranium ETF’s that might catch the trend. The Global X Uranium ETF (URA) comes to mind as an example. Second, an investor might consider the Sprott Physical Uranium Trust (SRUUF), although an investor would need to be able to trade Canadian stocks to purchase it. Last, an investor might look at a major provider of uranium like Cameco Corp (CCJ).

Registered Investment Advisor

Metas Investments LLC (“Metas”) is an investment adviser registered with the State of Texas and our fees and services are more particularly described in Form ADV Part 2A.

This presentation provides general information about the business practices and professionals of Metas. The information is not intended, and should not be construed, as legal, tax or investment advice. The information provided has not been approved or verified by any state or federal securities authority. Additional information about Metas is available on the Securities and Exchange Commission website at www.adviserinfo.sec.gov.

General Disclosure

This presentation is for informational purposes only and does not constitute an offer to provide advisory or other services by Metas in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. The information contained on this presentation should not be construed as financial or investment advice on any subject matter and statements contained herein are the opinions of Metas and are not to be construed as guarantees, warranties or predictions of future events, portfolio allocations, portfolio results, investment returns, or other outcomes. Viewers of this presentation should not assume that all recommendations will be profitable or that future investment and/or portfolio performance will be profitable or favorable. Metas expressly disclaims all liability in respect to actions taken based on any or all of the information on this presentation. Past performance does not guarantee future results. All investing involves risk. Investment return and principal value will fluctuate with changes in market conditions. Current performance of positions may be higher or lower than presented in this report. Nothing in this report should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Metas Investments does not provide tax advice and investors are

encouraged to consult with their personal tax advisors.

Follow us on all social media platforms for more timely market insights!

Metas Investments

11111 Katy Freeway STE 910

Houston, Texas 77079

Disclosures:

Form ADV

Investment Adviser Public Disclosure

FINRA BrokerCheck

Our Disclosures

Follow Us